What Is Unearned Revenue?

Content

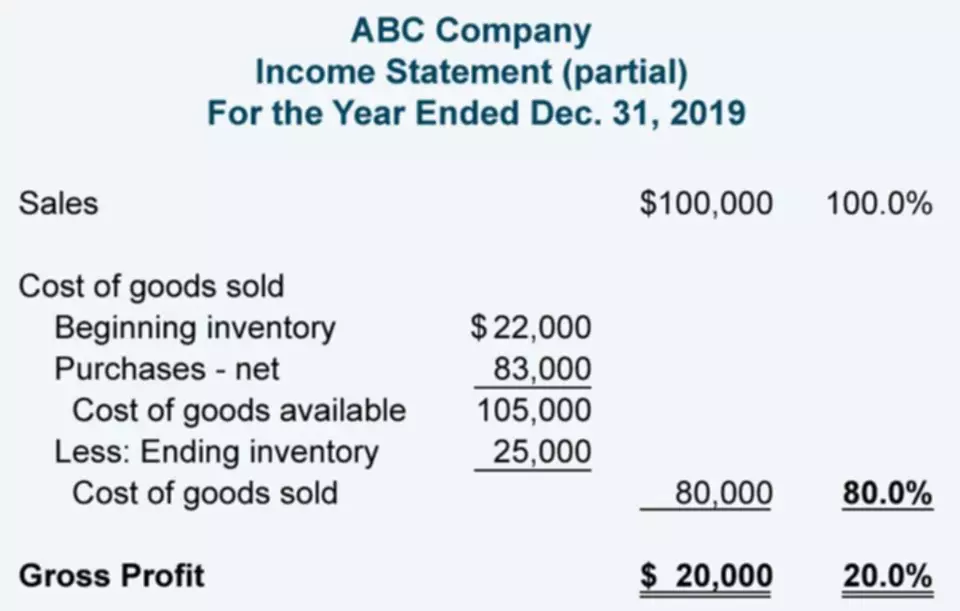

According to the accounting equation, assets should equal the sum of equity plus liabilities. In accrual accounting, revenue is included as income when it is generated. The work is done, the company is paid, and the amount is entered as income. Only earned revenue – money exchanged for a good or a provided service is included on the income statement. Another consideration is the stability of the unearned revenue liability throughout the operating cycle. This contrasts with a gradual draw-down of the liability over the cycle, suggesting the unearned revenue liability is more like a debt that needs to be repaid.

You record it under short-term liabilities (or long-term liabilities where applicable). Since it is a cash increase for your business, you will debit the cash entry and credit unearned revenue. Where unearned revenue on the balance sheet is not a line item, you will credit liabilities.

The Endless Possibilities of Unearned Revenue

Unearned revenue is originally entered in the books as a debit to the cash account and a credit to the unearned revenue account. Unearned revenue is income you have on your books that is waiting for the goods or services to go with it. For example, you sign a three-month, $1,000 per month deal with a customer in January, and the customer pays you $3,000.

In the case of subscription services, revenue installments are made at different times during the contract. For annual contracts, a prepayment is made at the beginning of the period. A business then would perform the service monthly and recognize a certain amount of revenue each month. With the provider and customer agreeing to delivery of a services or goods, at a specified time, for a specified price. These contracts will always cross over into another accounting period, often spanning a year or longer.

How to Convert Bank Deposits to Revenue in Accounting

As the expenses are incurred the asset is decreased and the expense is recorded on the income statement. Therefore, the revenue must initially be recognized as a liability. Note that when the delivery of goods or services is complete, the revenue recognized previously as a liability is recorded as revenue (i.e., the unearned revenue is then earned). Over time, the revenue is recognized what is unearned revenue once the product/service is delivered (and the deferred revenue liability account declines as the revenue is recognized). Like small businesses, larger companies can benefit from the cash flow of unearned revenue to pay for daily business operations. Securities and Exchange Commission (SEC) sets additional guidelines that public companies must follow to recognize revenue as earned.

- Once the business actually provides the goods or services, an adjusting entry is made.

- So, the trainer can recognize 25 percent of unearned revenue in the books, or $500 worth of sessions.

- The software helps you automate complicated and monotonous revenue calculations and situations.

- These Fees occur when customers pay for goods or services in advance, such as with a magazine subscription.

- This liability is noted under current liabilities, as it is expected to be settled within a year.

- The treatment of unearned revenue liabilities as working capital can result in a substantial reduction to the company’s operating assets.

- This includes collection probability, which means that the company must be able to reasonably estimate how likely the project is to be completed.